Welcome back to Exit & Equity, the email for serious self storage owners.

Today, we’re breaking down one of the most enduring principles in self-storage - knowing when you’ve captured peak value and how to recognize the signals before the market turns.

Let’s go!

&

IN THE KNOW

Operator A vs. Operator B: Consider two self-storage owners with similar facilities:

Operator A sold their facility in Q2 2021, guided by systematic data signals. They captured a 4.2% cap rate sale at 15% above asking price – effectively selling at the top of the market.

Operator B, in contrast, “waited for one more good year.” Now that year has come and gone: a 30% supply pipeline is hitting their market, occupancy is sliding, and buyers are only offering around 6.5% cap rates. Operator B is stuck holding a facility worth far less than it was at peak.

The difference wasn’t luck – it was tracking the right data. Most operators approach selling the way they approached their first date – nervously, without a plan, hoping for the best. Let’s fix that.

The Six-Signal Framework

Optimal exits aren’t about having a crystal ball, they’re about recognizing a confluence of signals. When four, five, or all six of the following indicators align, you’re likely in the sweet spot for a sale. Each of these six signals is a leading indicator, foreshadowing market conditions 6–24 months out. Below we break down each signal, what to watch, and why it matters.

"Optimal exits aren't about crystal balls — they're about a confluence of signals."

Signal #1: Market-Level Occupancy Trajectory

What to track: The rolling 12-month average occupancy in your local market or submarket (including your facility and key competitors).

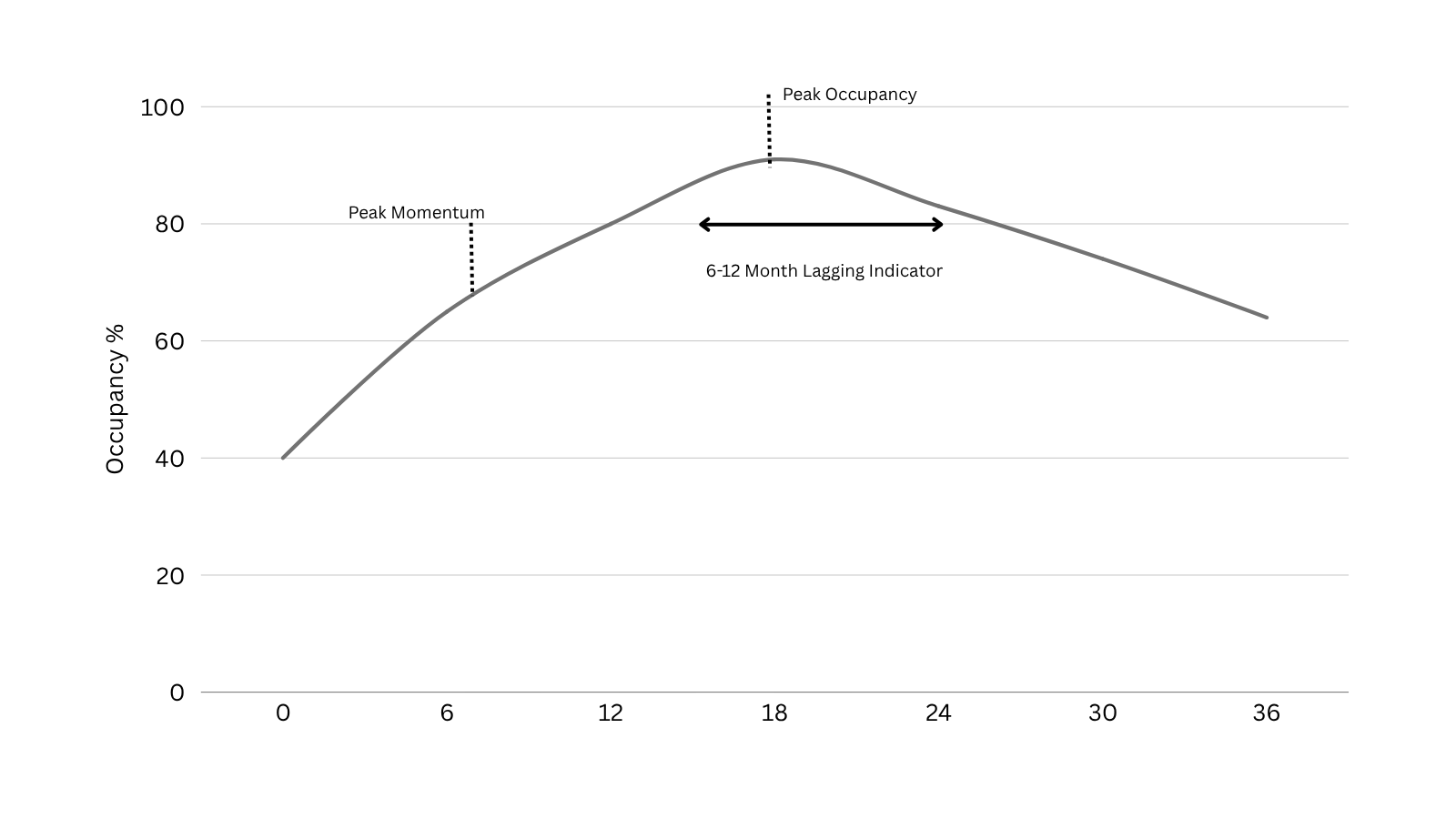

Leading indicator: When occupancy rates peak and you see momentum deceleration – i.e. occupancy is still high but growth has slowed markedly (from, say, +6% YoY to +1% YoY). The market hasn’t turned down yet, but it’s flattening out.

Why it matters: Occupancy leads pricing power by about 6–12 months. When facilities are near full and demand growth is slowing, rental rate gains typically lose steam shortly after. In other words, today’s occupancy plateau is a warning that tomorrow’s rates may soften.

Data sources: You can pull the “book knowledge” from tools like Yardi Matrix or Radius+, and that’s fine for getting city-level trends. But around here, we put just as much weight on street knowledge. We’re constantly secret-shopping local facilities, calling competitors, checking gate hours, and tracking move-in specials. The data tells you what’s happening. The street tells you why.

If you want the exact script I use when calling competitors, email me and I’ll send it to you

Real example: In Phoenix, market-wide occupancy hit ~94% in late 2021, after a rapid rise. Growth then almost flatlined (from ~+6% annual occupancy growth to about +1.5%). About 18 months later, rental rates in Phoenix began to compress as new supply and cooling demand caught up – a predictable slide following the occupancy peak. In fact, the self-storage sector overall saw an 18-month slowdown after the pandemic-era highs. An owner who noticed Phoenix’s occupancy momentum fading in 2021 could have timed their sale well before the 2023 market dip.

Signal #2: Cap Rate Cycle Position

What to track: Trailing 12-month cap rates for comparable self-storage sales in your market (and nationally). Basically, are properties trading at 4.5% caps? 5.5%? 6.5%?

Leading indicator: When market cap rates hit historical lows (indicative of peak pricing), or when they stop compressing and start stabilizing. The inflection from compression to flat or expansion is key.

Why it matters: Cap rates are the inverse of price. Low cap rate = high value. Once cap rates start expanding (rising), property values decline – and your window to sell at top dollar is closing. A shift from a 5% cap market to a 6%+ cap market can erode a huge chunk of your asset’s value.

Data sources: Brokerage comps and databases (CoStar, Real Capital Analytics/MSCI) often track cap rates on recent sales. Industry reports and self-storage REIT earnings calls can also signal where cap rates are trending. I prefer to keep good relationships with a few brokers in my network. They are the “boots on the ground” when it comes to cap rates.

Operator insight: Cap rates in the self-storage sector reached record lows around 2021 (deals in some regions closed at cap rates as low as ~3.5%!). Since then, with rising interest rates, cap rates have expanded back into the mid-5% to 6% range. The impact on value is enormous.

Signal #3: Supply Pipeline Density

What to track: The new supply pipeline in your market: all self-storage projects under construction or recently completed (but not full) plus those firmly in the development pipeline (approved or planned). Express this as a percentage of existing storage inventory in the market. Also track how long it’s taking recent deliveries to lease up (months to stabilization).

Leading indicator: When the pipeline exceeds ~5–8% of the existing stock and you observe lease-up periods stretching longer than 18–24 months for new facilities, trouble is looming. In other words, a big wave of new supply is set to hit, and absorption is slowing down.

Why it matters: New supply is kryptonite for rental rates and occupancy. A pipeline equal to, say, 10% of current inventory can signal a future glut that will compress margins 12–24 months out – well before buyers and appraisers fully price that pain in. If you sell before that supply hits, you avoid the coming storm (and the cap rate expansion that oversupply brings). If you wait too long, you’ll be selling into a buyer’s market of increased competition and concessions.

Data sources: City building permit filings and planning commission agendas (for proposed storage projects), Radius+ market reports, and local inside knowledge. Yardi Matrix reported, for example, that as of late 2021 the national development pipeline was about 8.7% of existing stock. Some overbuilt metros like New York and Philadelphia had pipelines nearing 18% of current inventory, a clear red flag.

Pro tip: Sophisticated buyers always model the incoming supply pipeline. If you’re not tracking it, you’re already at a disadvantage. Gone are the days when a new facility could lease-up to stabilization in 12 months. (In the unusual 2021 boom, some facilities filled in under 18 months – a once-in-career anomaly). Today, with more normal competition, a new storage project might pro forma 36+ months to stabilize. If your market is seeing protracted lease-ups and a hefty construction queue, it’s a leading indicator that pricing power will erode soon.

Signal #4: Employment & Housing Indicators

What to track: Local economic and demographic momentum – especially job growth rates, net migration, housing construction starts, and apartment absorption/vacancy. These factors drive the demand for self-storage (people and businesses need storage when they move, expand, or have transitional housing situations).

Leading indicator: Inflection points in these metrics. For example, your metro’s job growth was +3% and accelerating, but now it’s +1% and falling – a deceleration. Or housing permits that were rising 20% YoY have now flattened or turned negative. Even a sharp acceleration above trend can be a signal (e.g. a big population influx) that today’s high demand could normalize later. The key is change in trajectory.

Why it matters: Self-storage demand tends to lag population and housing trends by 6–12 months. If people and jobs are pouring into an area, storage rents and occupancy will climb accordingly (after a short delay). Conversely, if a once-hot market’s in-migration slows or the local housing market cools, you can expect storage move-in rates to soften not long after. For instance, markets with strong housing and job growth in 2021 (Phoenix, Dallas, much of the Sun Belt) saw self-storage rents surge 15%+ that year. But when those markets’ job and home sales momentum slowed, storage performance followed suit within the next year.

Data sources: Bureau of Labor Statistics (for employment figures), U.S. Census Bureau (population estimates, migration), local MLS or building association reports (housing starts, home sales), and apartment market reports (absorption and occupancy rates). Often, a quick look at your metro’s U-Haul migration index or U.S. Census net domestic migration stats can reveal whether people are coming or going.

Bottom line: Storage is a derivative play on population movement and housing churn. If the music in the housing and job market is slowing, don’t expect storage to keep dancing for long.

Signal #5: Transaction Volume & Liquidity

What to track: The velocity of sales in your market – how many comparable self-storage facilities are selling each quarter, and how long they take to sell (days on market). Also note the ratio of sale price to asking price.

Leading indicator: A hot, liquid market shows high deal volume and low days-on-market (e.g. properties trading hands in 30–60 days with multiple offers, often closing at or above asking). When you start seeing deal volume dry up – say, a 30–40% drop in transaction count year-over-year – and listings linger for 120+ days or require price cuts, that’s a regime change. The market is shifting to favor buyers.

Why it matters: Strong liquidity means lots of active buyers and readily available financing – prime conditions to sell. When liquidity dries up, buyers gain leverage (fewer bidders, more cautious underwriting). By the time you realize your market is illiquid, prices have already adjusted downward. For example, after the frothy 2021 sales boom, self-storage transaction volume had fallen roughly 40% by 2023 as interest rates rose and buyers got skittish. If you waited until everyone knew the market was slow, you were negotiating in a buyer’s market. The goal is to sell while the market is still liquid (or just as it starts to turn).

Data sources: CoStar and Real Capital Analytics publish sales volume data. Brokerage firms’ quarterly self-storage updates often mention if transaction counts are up or down. Even anecdotally, talk to brokers: Are they seeing bidding wars or crickets? How many facilities are on the market versus a year ago? If listings in your area used to get 10+ offers and now “the one buyer” is chipping away at the price during a 4-month escrow, liquidity has shifted. Red flag: deals taking over 4 months to close and consistently trading below initial ask – that’s a sign of a cooling market.

Signal #6: Interest Rate Expectations

What to track: The trajectory of interest rates, especially the Fed Funds rate and 10-year Treasury yield, and what the market expects them to be in the near future. In practice, watch the Fed’s commentary and futures market (e.g. the CME FedWatch Tool) for rate forecasts, and monitor lending rates for commercial mortgages (CMBS, bank loans) in real time.

Leading indicator: Two scenarios to note: (1) When a hiking cycle is ending – rates stabilize after a rapid rise, signaling that financing costs might not worsen further. And (2) when rate cuts are expected (priced in) but haven’t happened yet – e.g. the market is optimistic that borrowing costs will improve in the next year. These moments often buoy buyer sentiment. Conversely, if the market suddenly expects a surge in rates, buyers will get cautious fast.

Why it matters: Borrower cost of capital directly dictates what buyers can pay for your facility. Lower rates = lower debt service = higher price (all else equal). When interest rates fell to near-zero, cap rates compressed and valuations skyrocketed. When rates spiked in 2022-2023, real estate values dipped across the board. The expectation of rate moves often drives buyer behavior even before the moves happen. An astute seller will exit while optimism is high. For example, if investors believe rates will drop next year, you might see aggressive offers today (they’re banking on cheaper refinancing ahead). But if those cuts fail to materialize, the window closes. Timing your sale just as the market anticipates easing monetary policy – but before everyone actually gets cheap money – can secure a premium price. It’s the multiplier effect: when buyers think their financing will get cheaper, they are willing to pay more.

Data sources: The Federal Reserve’s signals (press releases, dot plots) and tools like the CME FedWatch (for odds of future rate hikes/cuts) will keep you informed. Also follow the 10-year Treasury yield, as it’s a benchmark for long-term CRE loan rates. Industry capital markets reports (CBRE, JLL, etc.) often discuss how anticipated rate changes are impacting buyer sentiment. In short, keep one eye on the Fed and one on the bond market – they are the tide that lifts or lowers all boats.

When the Signals Align: Your Exit Window Opens

By tracking these six signals, you build a dashboard for timing your exit. You don’t need all six to flash green to act. Typically, when 4 or 5 of the indicators line up favorably, the case for selling becomes very strong. Think of it like a scorecard – the more green lights, the safer it is to proceed through the intersection.

Let’s say you evaluate your market today on all six signals. Perhaps occupancy is near peak and flattening (Green), cap rates are at a low plateau (Green), supply pipeline is moderate (Yellow), economic metrics are still decent (Green), transaction volume is starting to slow (Yellow), and interest rates have stabilized (Green). That might be 4 Greens and 2 Yellows – a signal that you are entering a prime exit window. On the other hand, if you only have one or two positives and several red flags, it’s probably wise to hold off; your market hasn’t ripened yet for an optimal sale.

Below is an example of what an Exit Readiness Scorecard might look like, scoring each signal:

Signal | Current | 12-Mo Trend | Vs. Hist. Avg | Status | Notes |

|---|---|---|---|---|---|

Occupancy | 93% | Flat (+0.5% YoY) | Above (91% avg) | Green | Near all-time high; momentum stalling |

Cap Rates | 4.8% | Stabilized at low | Below (6% avg) | Green | Cycle low cap rate = high valuation |

Supply Pipeline | ~9% of inventory | Rising | Above (4% avg) | Red | Large wave of new supply coming |

Job & Pop Growth | +2.0% jobs YoY | ↓ (was +3%) | Above (1% avg) | Yellow | Growth slowing, still above norm |

Deal Volume | –10% YoY | ↓ (down from peak) | Near norm | Yellow | Liquidity off peak; fewer bidders |

Interest Rates | 5.0% (Fed Funds) | Peaking/leveled | High vs last decade | Yellow | Rate cuts expected next year |

In this hypothetical market scorecard, we have 2 Greens, 3 Yellows, 1 Red. It’s a mixed picture – maybe not a slam-dunk “sell now,” but certainly a situation to watch closely. How do you turn such analysis into a decision? Use a simple decision matrix:

5–6 Green signals: Prep for exit now. You’re in an optimal window. That means getting an appraisal updated, tightening up your financials, and quietly shopping the deal or engaging a broker before the window closes.

3–4 Green signals: You’re on the cusp. This warrants active monitoring and preliminary prep. Maybe you don’t list the property tomorrow, but you ensure your books are clean, your facility is in tip-top shape, and your broker relationships are warm. You might even set a price target and start fielding off-market feelers.

0–2 Green signals: Likely not the time to sell. Focus on operations and value-add for now. Your market signals suggest you’re early in the cycle or in a slump. Better to create value internally (lease up, raise rents, improve NOI) and wait until more signals turn favorable.

&

MAKE IT MODERN

This all sounds great – but how do you actually implement it without drowning in data? Most operators nod along to frameworks like this and then revert to “business as usual.” To truly benefit, you need to bake these signals into your quarterly routine. Here’s how to operationalize it with minimal effort, even if you’re not a spreadsheet whiz. Think of it as a 30-minute quarterly ritual that keeps you ahead of the pack:

Set up a simple tracking spreadsheet. Create a Google Sheet (or Excel file) with a row for each of the 6 signals. Use columns for: Date of measurement, Current Value, 12-Month Trend (e.g. an arrow up/down or percentage change), Versus Historical Average, Status (Green/Yellow/Red), and Notes. This becomes your one-page dashboard. (If you prefer a head start, use a template.

Want a head start? email me for a copy of my template

Each quarter, you’ll update the numbers and see the trend colors light up.

Automate what you can. Leverage free data feeds to reduce manual work. For example, use Google Sheets’

IMPORTXMLorIMPORTHTMLfunctions to pull data like Treasury rates or Fed forecasts automatically. Set up Google Alerts for terms like “self-storage sales [Your City]” to catch news of local transactions and development. Subscribe to industry reports – Yardi Matrix, for instance, offers free monthly/quarterly summaries on self-storage occupancy and rent trends. These can feed you the occupancy and rate data for Signal #1. The goal is to have as much information flow to you as possible, so your quarterly update is mostly gathering and reviewing, not hunting.Create a local supply pipeline log. This one is more manual but worth the effort. Once a quarter, spend 10 minutes checking your city’s permit database or planning commission minutes for new self-storage projects. Keep a simple list of upcoming facilities: address, size (sq ft or unit count), and expected opening date. Add a column calculating pipeline % of existing stock (e.g. “New supply 1.2M sq ft = 7% of current market inventory”). This will populate your Signal #3. Over time, you’ll see the pipeline number change – and you’ll likely hear how fast those new entrants are filling up (through industry chatter or calls to competitors). Log any anecdotal evidence in the Notes column.

Visualize and report. People absorb information from visuals, so consider creating a one-page dashboard or PDF each quarter. This could be as simple as a screenshot of your colored spreadsheet or a small bar/line chart for each signal. Use conditional formatting in your sheet to color-code cells (e.g. occupancy % turns red if it drops, pipeline % turns red above 8%). The dashboard is not just for you – include it in your investor or partner updates! It shows stakeholders that you’re data-driven and strategic, not just reactive. (Plus, explaining the green/yellow/red lights to others will force you to stay disciplined in your analysis.)

The Compounding Advantage: The true edge comes from consistency. Tracking these signals every quarter for a couple of years will hone your intuition. You’ll start recognizing patterns – “Hey, last time occupancy and job growth dipped while supply spiked, cap rates in our region went up within two quarters.” That kind of pattern recognition is basically a 12–18 month head start on the average reactive seller. Most storage owners meticulously track their income statement but pay little attention to market indicators. By doing both, you compound your advantage. Pro move: Even if you have no plans to sell imminently, track the signals anyway. When that unsolicited offer email lands in your inbox (and at some point, it will), you can instantly size it up: Is this offer hitting while my market is near peak (maybe take it), or is my market in a valley (probably hold out)? You’ll make better hold/sell decisions than 95% of your peers, simply because you’ll have data to counterbalance the emotion and hype.

The Exit You Don’t Regret

Most wealth in self-storage is built through years of operational excellence – but a huge chunk of that hard-earned wealth can evaporate with one poorly timed sale. This framework isn’t about trying to hit the absolute peak of the market; it’s about avoiding the trap of terrible timing. Selling after the fundamentals have started deteriorating – when new supply is flooding in, demand is softening, and values are sliding – is a recipe for seller’s remorse. On a large facility (say, $1M annual NOI), the difference between selling at a 5% cap versus waiting until buyers demand a 6.5% cap can be on the order of $3–5 million less in sale proceeds. No amount of expert management can make up for that kind of value destruction.

The good news: recognizing your optimal exit window doesn’t require psychic powers or expensive consultants – just discipline and data. By tracking the six signals above, you’re doing something most of your competitors aren’t. You’re treating your exit strategy as an integral part of your business plan, not an afterthought. Start tracking these indicators this quarter, and by next year you’ll have a baseline that puts you ahead of the curve. When the market whispers that it’s time to sell, you won’t just hear it – you’ll see it quantified on your dashboard. And you’ll act with confidence, not second-guessing.

The best time to plan your exit was three years ago. The second-best time is today – before the market tells you it’s too late. Start now, build your exit strategy into your operations, and you’ll be poised to hit your next disposition out of the park instead of wondering “what if.”

&

BEFORE YOU GO

Links I found interesting this week

&

FROM THE STOICS

That’s all for today.

It is not the man who has too little, but the man who craves more, that is poor

— Seneca