Welcome back to Exit & Equity,

the email for serious self storage owners.

This week, I'm showing you the $70k tax you're paying every year without realizing it

Let’s go!

&

IN THE KNOW

The Real Cost of Being "The Guy

Last Tuesday at 8:47 PM, you were standing in the hallway of your climate-controlled building, explaining to a tenant why their unit door wouldn't close properly. A $40 part. Fifteen-minute fix. But your manager couldn't authorize a repair over $25 without you, so here you are, two hours after the text came in, missing dinner with your family over a door latch.

This wasn't an emergency. The tenant could access their unit just fine. But your process required you to be there.

You drove home thinking about the numbers. Revenue's up. Occupancy's solid. By every conventional metric, you're winning. So why are you working more hours than ever? And why has your spouse stopped asking when you'll be home for dinner?

Here's an exercise that will ruin your week: track where your time actually goes for seven days. Not where you think it goes—where it actually goes. Most operators who do this discover 30-35 hours spent on tasks that add zero value to tenants. Approving routine maintenance. Answering questions their team already knows the answers to. Pulling reports from three different systems. Moving data between spreadsheets. Responding to emails that could have been handled by anyone with access to a procedure doc.

Quick math: 35 hours × $40/hour (conservative—your real value per hour is much higher) × 50 weeks = $70,000 annually. Seventy thousand dollars of your time spent on work that shouldn't require you at all.

You haven't built a business. You've built yourself an expensive job.

The Year-End Moves No One’s Watching

Markets don’t wait — and year-end waits even less.

In the final stretch, money rotates, funds window-dress, tax-loss selling meets bottom-fishing, and “Santa Rally” chatter turns into real tape. Most people notice after the move.

Elite Trade Club is your morning shortcut: a curated selection of the setups that still matter this year — the headlines that move stocks, catalysts on deck, and where smart money is positioning before New Year’s. One read. Five minutes. Actionable clarity.

If you want to start 2026 from a stronger spot, finish 2025 prepared. Join 200K+ traders who open our premarket briefing, place their plan, and let the open come to them.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

Most operators know they work too much. What they don't know is the actual cost and I'm not talking about the obvious stuff like your hourly rate multiplied by hours worked. The hidden tax of manual operations runs three to five times deeper than the visible labor costs.

Research on document processing reveals the multiplication effect. A company thinks manual invoice processing costs them $87,500 annually based on direct labor hours. When they actually measure the true cost—including error remediation, supervision time, training overhead, delayed decisions, and rework cycles—the real number comes in at $548,500. That's 6.3 times the perceived cost.

For storage operators, this plays out in ways we don't track. A tenant wants to move in today. Without automated systems, here's what happens: They call, leave a message because you're at the other property. You call back 90 minutes later. They're not available. You play phone tag twice more. Finally connect, walk them through unit sizes and pricing. They want to think about it. You follow up manually three days later. They've already rented from your competitor down the street who responded in 10 minutes with an automated text, link to see units, and online reservation option.

You didn't lose that customer because of pricing or location. You lost them because your manual process introduced a 90-minute response delay, and in 2026, that's a dealbreaker.

But the cost multiplies beyond lost revenue. Manual operations create decision bottlenecks that slow everything by 40-60%. At our Aiken-University property, I realized I was the bottleneck. My virtual manager couldn't approve routine maintenance without me. She couldn't adjust pricing without me. She couldn't resolve a billing dispute without me. Every decision queued up, waiting for my calendar to have availability.

This doesn't just slow operations—it fundamentally changes your business model. You're not running a facility; you're running a queue. Projects that should take three days stretch to seven because they're waiting for your approval at three different decision points.

The valuation impact of founder dependency hits harder than most operators realize. When I started exploring what our property might be worth if I ever wanted to sell or bring in a partner, the numbers sobered me fast. Facilities that run independently—where the owner isn't required for daily operations—sell for seven to eight times EBITDA in the current market. Founder-dependent facilities? Three to four times EBITDA, if you can find a buyer at all.

That's a 50% valuation haircut, not because the financial performance is worse, but because a buyer recognizes they're not buying a business—they're buying an expensive job that requires the seller to stay involved or requires them to completely rebuild operations.

I was working 60-hour weeks to build an asset worth half what it could be. The math didn't work.

Why Your 94% Occupancy Is Costing You Money

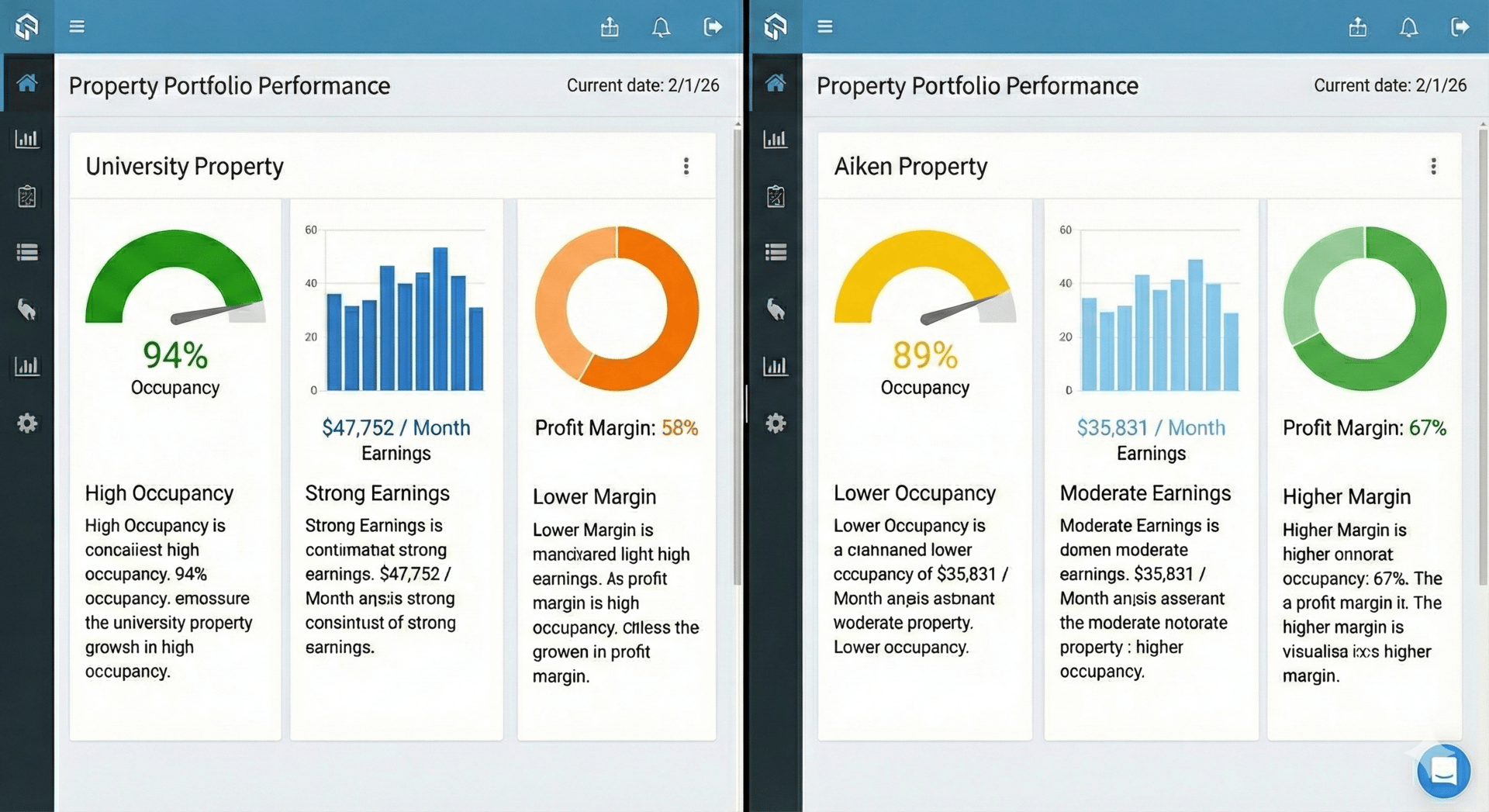

Let me show you something that changed how I think about occupancy. Our University facility: 94% occupied, 400 units, averaging $127/month. That's $47,752 in monthly revenue. Our Edgefield facility: 89% occupied, 350 units, averaging $115/month. That's $35,831 in monthly revenue.

First one looks better, right? Higher occupancy, higher rates, more revenue. Except when I dug into the actual profit margins, University was outperforming Edgefield by almost $3,000 monthly on a per-square-foot basis after accounting for the different footprints.

How? Because University's 94% occupancy was a symptom of underpricing. We were the cheapest option in our market. Every unit type was 8-12% below market rate because I was terrified of vacancies. I was manually checking rates maybe once a month, making conservative pricing decisions to avoid any tenant pushback.

Edgefield, running with clearer systems and a manager empowered to make pricing adjustments weekly, stayed within 2-3% of market rates. The 89% occupancy wasn't a problem—it was exactly where we wanted to be. We had pricing power. When someone called, they rented because of location and service, not because we were the cheapest.

The manual pricing process at University created another hidden cost: decision fatigue. Research on decision-making quality throughout the day shows that late-day decisions are 23% lower quality than morning decisions. When you're manually reviewing pricing, approving maintenance, handling tenant calls, and making operational decisions all day, your cognitive capacity depletes.

I noticed this pattern in my own behavior. Morning pricing decisions were analytical, I'd compare to market rates, consider seasonal factors, look at move-out trends. By 6 PM, pricing decisions were reactive "Is this tenant going to be upset? Let's just keep it the same."

That decision fatigue was costing me 8-12% in revenue annually at University property. Not because I didn't know better, but because I was making too many decisions and running out of mental energy for the ones that actually mattered.

High occupancy without pricing power means you're the cheapest, not the best. And being the cheapest is expensive—you're leaving revenue on the table while working harder to maintain that occupancy through superior service that your rates don't reflect.

The AI Revolution Nobody Prepared You For

Here's what changed in the last 18 months: automation tools that used to require developers and six-figure budgets now cost $30-50 monthly and can be set up by anyone who can use a spreadsheet.

I'm not talking about buying expensive property management software that promises everything and delivers half. I'm talking about connecting the software you already use, your property management system, your phone, your email, your spreadsheets, so they talk to each other and handle routine work automatically.

A Nashville HVAC contractor (not storage, but the principle applies directly) was getting 150 inquiry calls monthly. His team was responding within four hours on average—pretty good by traditional standards. But his conversion rate was stuck at 22%. He implemented a simple automation: when someone called and left a voicemail, the system immediately sent them a text with a link to see available appointment times, along with a PDF showing pricing for common repairs.

Response time dropped from four hours to 10 minutes. Conversion rate jumped from 22% to 28%. That's nine additional jobs monthly at an average of $450 each—$4,050 in additional monthly revenue. The automation platform cost $50/month.

ROI: 8,000%. Payback period: one week.

For storage operators, the applications are obvious. Lead comes in through your website at 7 PM on Saturday. Instead of waiting until Monday morning when you check email, the system instantly texts them: "Thanks for your interest in [Property Name]! We have [X] units available in the size you're looking for. Here's a quick video tour: [link]. Want to reserve one? Click here: [link]. Questions? Text me back."

The prospect gets an immediate response, can see exactly what they're renting, and can reserve it right then when their interest is highest. You didn't touch it. No app to log into. No manual text to send. The system handled it.

Invoice processing shows the same dramatic improvement. Manual invoice processing averages $12.88 per invoice when you account for data entry time, matching, approval routing, and filing. Automated invoice processing: $2.70 per invoice. That's a 78% cost reduction. For an operator processing 500 invoices monthly (vendors, maintenance, utilities, contractors), that's $5,090 in monthly savings, or $61,080 annually.

The tools making this possible are platforms like Zapier (connects different software), Make (similar but more powerful for complex workflows), and Airtable (replaces spreadsheets with databases that can trigger automations). None require coding knowledge. You connect your apps, define what should happen when something occurs, and the platform handles it.

Example workflow I built in 90 minutes: When a tenant submits a maintenance request through our property management software, it automatically creates a record in our maintenance tracking system, sends a text to the tenant confirming we received it and providing an estimated response time, checks if the issue matches any of our "urgent" keywords (water, lock, break-in), and if so, immediately texts me with details. Non-urgent requests queue up for our manager to review during business hours.

This workflow eliminated 15 hours weekly of my time spent manually triaging maintenance requests and updating tenants. At $40/hour, that's $600 weekly or $31,200 annually. The automation platform costs $29.99/month. Annual ROI: 10,300%.

The contrarian truth that most operators miss: you don't need developers or big budgets anymore. A facility manager with basic computer skills can build these systems. The barrier isn't technical capability—it's the mental shift from "this is how we've always done it" to "what if we didn't have to do this at all?"

AI takes this even further. Modern automation platforms now include AI that can read emails, understand context, and make decisions. A tenant emails asking about unit availability, pricing, and move-in requirements. AI reads the email, checks your availability in real-time, generates a personalized response with current pricing and a link to reserve, and sends it—all in under 30 seconds.

This isn't science fiction. This is what's available today for $50-100 monthly. The question isn't whether the technology works—it does. The question is whether you're willing to invest 10-20 hours learning to use it to reclaim 20-30 hours weekly forever.

&

MAKE IT MODERN

Your First Automation in a week

Most operators fail at automation because they try to boil the ocean. Start with one workflow: automated lead response.

What you need: Zapier or Make.com ($30/month), Twilio for SMS ($20/month), your existing PMS.

The workflow: Someone submits a contact form → system checks your PMS for available units in their requested size → immediately texts them with availability, pricing, a virtual tour link, and a reservation link. Their reply comes to your phone, but they already have everything they need to move forward.

Setup time: 2 hours, including learning the platform.

The math from our University property: 150 monthly inquiries, manual response time averaged 4 hours, 24% conversion rate. With 10-minute automated response, conversion increased to 28%. That's 6 additional rentals monthly × $127 = $762 in new revenue, plus 15 hours weekly saved in manual follow-up ($2,400/month in labor). Total monthly benefit: $3,162. Monthly cost: $50.

Once you see that work, you'll build the next two automations yourself: tenant communication sequences (payment reminders, move-in welcome series, renewal outreach) and an automated daily reporting dashboard. Each one takes 2-3 hours to set up and saves 4-8 hours weekly.

The hardest part isn't learning the software. It's confronting the reality that you've been doing $15/hour work while telling yourself you don't have time for $500/hour strategy work.

&

BEFORE YOU GO

Links I found interesting this week

&

FROM THE STOICS

Every new thing excites the mind, but a mind that seeks truth turns from the new to the old and tries to find out what is lasting.

— Seneca