Welcome back to Exit & Equity, the email for serious self storage owners.

This week, we’re tackling the operational threat nobody wants to talk about but everyone is already feeling: the climate premium. Insurance isn’t a footnote anymore it’s becoming one of your biggest underwriting risks.

Let’s go!

&

IN THE KNOW

The Climate Premium: Why Your Insurance Bill Just Became Your Biggest Underwriting Risk

Insurance costs in high-risk markets have jumped 40-150% in three years, turning formerly safe underwriting into value traps. Here's how to quantify climate risk before it destroys your NOI.

"If you wish to drown, do not torture yourself with shallow water." — Bulgarian Proverb

If climate risk is real, half-measures won't save you—either underwrite it properly or avoid the exposure entirely

A Hard Look at the New Insurance Reality

In 2020, a self-storage operator acquires a Class A facility in Tampa. They underwrite annual insurance at $0.08 per square foot, roughly $32,000 on a 400,000 sq. ft. property. Fast forward to the 2024 renewal: the quote comes back at $0.21 per square foot (about $84,000). No claims were filed. The building never flooded. The premium still jumped 162.5%. That’s an extra $52,000 straight off the NOI. At a 6% cap rate, this single line-item hike vaporized $867,000 in asset value. Multiply that across a 10-property portfolio, and you're looking at $8.6 million in enterprise value gone.

The kicker? Nothing “bad” happened to trigger this. The only thing that changed was the actuarial reality of climate risk. Insurance carriers recalculated the odds of catastrophe in coastal Florida and priced the policy accordingly.

While self-storage conference panels still debate whether climate change is “real,” insurance underwriters have already priced it in.

The question isn’t whether this will hit your portfolio, it’s whether you’re modeling it before your next acquisition blows up your pro forma. As one risk expert noted, you can deny climate change politically, but “when insurance is going up because you live in a risky area, that’s hard to deny”

The Insurance Market Has Fundamentally Broken

The insurance industry underwent a structural shift in just a few years. Major carriers like State Farm, Allstate, and Farmers have pulled out of entire states (Florida, California, Louisiana) or stopped writing new policies in the most disaster-prone regions. Reinsurers (the insurers for insurance companies) hiked their rates drastically, up 30–50% on catastrophe reinsurance in the past year alone after back-to-back years of billion-dollar disasters. In states hit by consecutive hurricanes and wildfires, claims frequency and severity created an actuarial death spiral: higher losses drive insurers away, which drives up costs for the remaining few, which drives even more insurers to withdraw. The result is an insurance market on the brink in certain regions. Florida and Louisiana have struggled to maintain healthy insurance markets after repeated catastrophic hurricanes. California’s wildfire belt saw enrollments in the state’s last-resort insurer (the FAIR Plan) surge to over 272,000 homes in 2022 as private companies pulled back. In Florida, the state-run Citizens Insurance—meant to be the insurer of last resort—ballooned to 1.4 million policies by late 2023 as private carriers fled the market.

Why Self-Storage Operators Ignored This: Insurance was a boring 2–4% line item. Pro-forma’s plugged in 3% annual increases automatically. Brokers weren't sounding alarms (they get paid on premiums, after all). Industry conferences focused on tech and marketing while insurance risk got zero attention. We simply renewed policies each year without scrutinizing creeping costs or changing terms.

In exposed markets, insurance has surged from 2–3% of revenue to 5–8% today. That's giving up an entire annual rent increase just to stay insured. Rate hikes now maintain coverage instead of boosting NOI.

Insurance carriers have billions and armies of PhDs calculating risk. When they flee markets or triple premiums, they know something your broker isn't telling you. While the real estate establishment downplays climate exposure, savvy operators are reading the writing on the wall.

Learn Real Estate Investing from Wharton's Best Minds

In just 8 weeks, learn institutional-grade real estate analysis and modeling from Wharton faculty and seasoned investors.

You’ll gain:

Insider insights on how top firms like Blackstone and KKR evaluate deals

Exclusive invites to recruiting and networking events

Direct access to Wharton faculty and a certificate that signals credibility

Join a thriving community of 5,000+ graduates for ongoing career development, networking, and deal flow.

Use code SAVE300 at checkout to save $300 on tuition + $200 with early enrollment by January 12.

Program starts February 9.

The Risk Matrix: Where the Climate Premium Bites Hardest

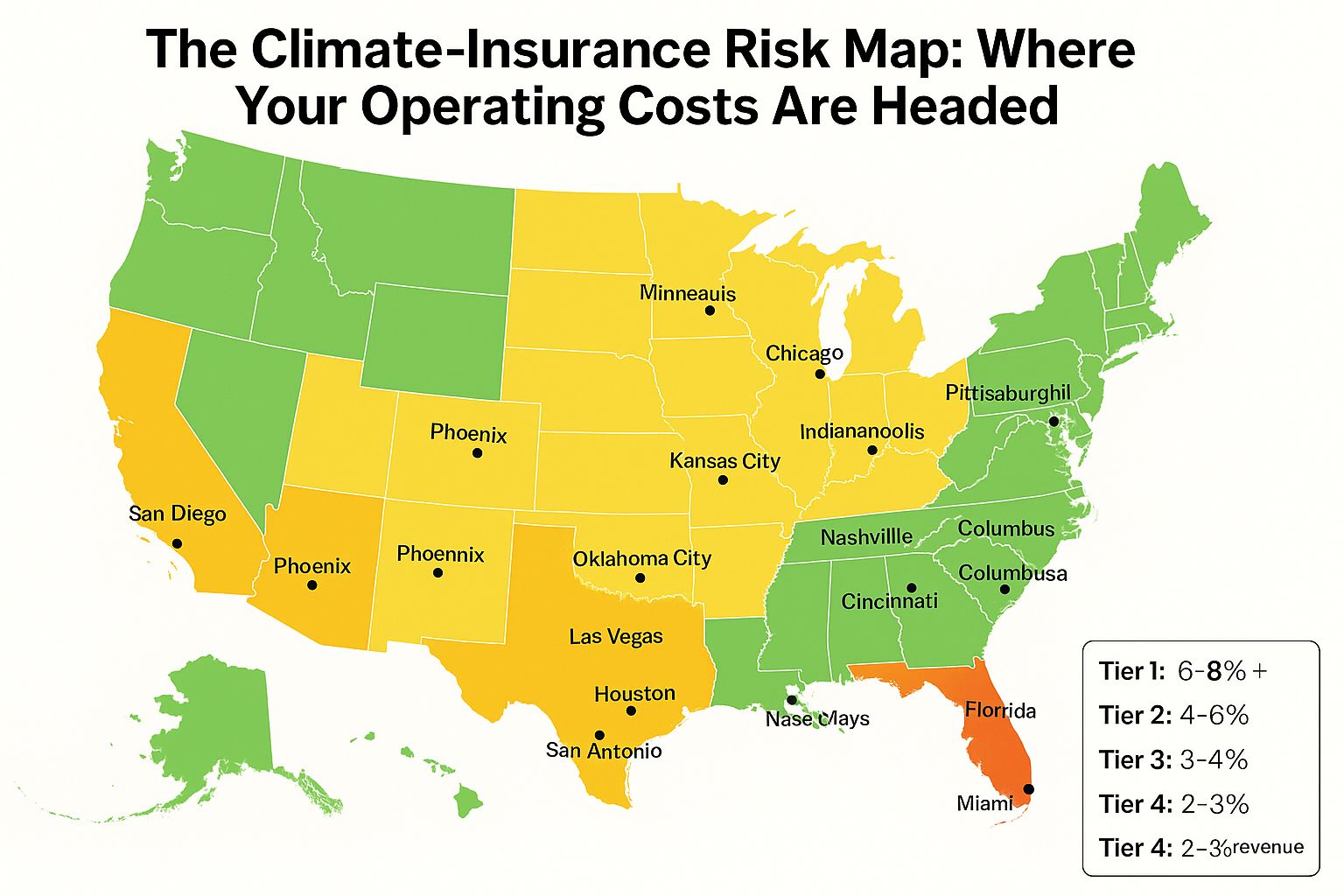

Not all markets are equal when it comes to climate-driven insurance pain. We can categorize self-storage markets into risk tiers based on recent insurance inflation and exposure:

Tier 1: Acute Risk (100%+ premium inflation, insurance crisis zones)

Markets: South Florida (Miami, Fort Lauderdale, Tampa, Fort Myers), Louisiana Gulf Coast, California wildfire zones (e.g. Inland Empire, Sierra foothills), parts of the Texas Gulf Coast.

Primary Threats: Catastrophic hurricanes, storm surge flooding, major wildfires, coastal flooding.

Insurance Market: Major carriers have largely withdrawn; operators rely on state-backed pools or surplus lines. Limited competition, high deductibles, and exclusions are common.

Current Trajectory: Premiums are still skyrocketing annually. In many cases, even basic coverage is harder to obtain and comes with strings attached (e.g. windstorm deductibles equal to 5% of property value).

Operator Implication: Avoid new acquisitions here unless you underwrite for 10%+ annual insurance increases (and even then, proceed with extreme caution). Consider these markets “toxic” unless priced at a significant cap rate discount to compensate.

Tier 2: Elevated Risk (40–75% premium inflation)

Markets: Coastal Carolinas (e.g. Charleston, Wilmington), Phoenix, AZ and Las Vegas, NV (extreme heat and wildfire-adjacent areas), Coastal Georgia, parts of coastal Alabama/Mississippi, Northern California (wildland-urban interface areas).

Primary Threats: Regular hurricanes (though less intense than Tier 1 areas), expanding wildfire seasons, extreme heat and water scarcity, severe convective storms.

Insurance Market: Some national carriers remain but often with stricter terms. Reinsurance costs are filtering down. Deductibles for wind/hail are higher; certain perils may be excluded without extra riders.

Current Trajectory: Premiums have hit a new plateau and continue to rise, though the curve may start to flatten to moderate single-digit increases after the recent big jumps. However, any major event could trigger another spike.

Operator Implication: Underwrite very conservatively. Bake in 6–8% annual insurance escalation for the first few years. Scrutinize policy terms (if a wildfire or hurricane isn’t explicitly covered in the base policy, that’s a problem). Deals can still pencil, but only with eyes wide open on risk.

Tier 3: Moderate Risk (25–40% premium inflation)

Markets: Examples include Atlanta, GA; Dallas/Fort Worth (inland TX); Nashville, TN; parts of inland North Carolina; Denver, CO (severe hail zones).

Primary Threats: Severe thunderstorms and hail, occasional tornadoes, maybe peripheral wildfire or hurricane effects but not direct hits.

Insurance Market: Pretty normal functioning insurance markets, but with an uptick in premiums. Carriers are adjusting rates upward for increased storm activity but haven’t massively pulled out.

Current Trajectory: Above historical inflation, but generally in the mid-single-digit percentage increases per year now. Manageable if budgeted for.

Operator Implication: Use a 4–5% annual insurance growth assumption in underwriting for safety. These markets are still financeable and insurable with standard carriers. Focus on good risk management (roof quality, hail-resistant materials, etc.) to keep premiums in check.

Tier 4: Low Risk (<25% premium inflation)

Markets: Much of the Midwest and Rust Belt – Columbus, Indianapolis, Cincinnati, Pittsburgh, Kansas City, Minneapolis, etc., plus pockets of the Northeast and Mountain West that aren’t prone to big disasters.

Primary Threats: Occasional localized flooding or wind storms, but minimal exposure to large-scale catastrophes. Maybe some winter storm risk, but that’s typically less costly.

Insurance Market: Stable and competitive. Plenty of carriers willing to write policies. Premium changes mostly track general inflation and loss history of the individual property.

Current Trajectory: In line with or only slightly above CPI. In many Tier 4 markets, operators have seen only modest insurance increases (e.g. 5-10% total over three years).

Operator Implication: These “boring” markets are suddenly very attractive from a risk-adjusted perspective. Standard 3% escalation assumptions hold reasonably true here. This is where you can gain a competitive advantage by operating in the climate-safe zone while others chase growth in riskier locales.

Some of the best self-storage markets of the past decade (Florida, Phoenix, coastal Southeast) may be the worst markets of the next decade

Not because customer demand will disappear, but because insurance costs will eliminate margin faster than rent growth can replace it. In five years, we’ll likely look back at 2024 and laugh at those who paid premium cap rates for Florida or California facilities without pricing in the insurance apocalypse. The Midwest may not be “sexy,” but it’s solvent.

How to Actually Underwrite This Risk

It’s time to update your underwriting playbook. Here are concrete adjustments to make for acquisitions going forward:

Ditch the 3% Escalation Fantasy – The old model of applying a flat 3% annual increase to insurance in the out years is dangerously outdated. New model: use a market-specific escalation. For Years 1-2, use actual quotes from insurance providers (plus any known upcoming changes). For Years 3-5, underwrite something like 8-12% in Tier 1 markets, 6-8% in Tier 2, 4-5% in Tier 3, and so on. Maybe by Years 6-10 you can taper those to slightly lower (say 5-7% in Tier 1, down to 3% in Tier 4) as markets adjust—but never assume flat inflation for high-risk areas. This way, you’re at least in the ballpark of reality.

Stress Test Your Downside – Don’t just assume the best case. In your deal model, run a stress scenario where insurance costs double suddenly in Year 3. What happens to your DSCR and cash-on-cash? Does the deal still meet your covenants and investor hurdles? If a mere insurance spike breaks the deal, that deal is a ticking time bomb. Better to pass now than to scramble later. Also consider liquidity: if your wind deductible is 5% of property value, could you swallow a $500k expense if a hurricane hits? Model a scenario with an uninsured loss or giant deductible payout in Year 5. It’s painful, but so is bankruptcy.

Demand Coverage Details Upfront – Before you finalize a purchase, dig into the insurance. Ask the seller (or your insurance broker) for five years of loss runs on the property – this tells you its claims history, not just three years. Get a copy of the current policy and scrutinize: What’s the wind/hail/hurricane deductible? (In coastal areas, 2–5% of insured value is common. Do the math: a 3% wind deductible on a $10 million property = $300,000 out of pocket per event.) Are there exclusions for certain perils like flood or quake? Is flood insurance separate (often, yes)? Is the carrier financially solid (A.M. Best rating of A or better)? If the current carrier is pulling out of the market, your renewal could be with a surplus lines carrier at twice the price. In short, no surprises—make the insurance due diligence as important as your environmental or title due diligence.

Build the “Climate Premium” into Valuations – Cap rates exist to price risk. So price this risk in. If Market A historically traded at a 6% cap and Market B at a 6% cap, but A is now facing huge climate costs, Cap A should rise relative to B. For example, suppose top-tier Midwest facilities trade around 5.5% cap and coastal Florida similar assets at 5.5%. Post-climate-adjustment, maybe Florida should trade at 6.0% (or higher) to compensate for the lower net income certainty. A rough rule of thumb: in today’s environment, add 25–50 basis points to the cap rate for high climate-risk markets to achieve the same risk-adjusted return. If sellers or brokers balk at that notion, walk away or be prepared to eat the cost later. Geographic risk diversification is now a key value factor.

Rebalance Your Portfolio Geography – If you already own multiple facilities, look at concentration. Is 70% of your NOI coming from Tier 1 and 2 markets? If so, you’re one bad hurricane season away from a major earnings hit. Consider strategic rebalancing: sell one or two high-risk assets (while cap rates are still relatively low and buyers still somewhat ignorant), and redeploy into lower-risk regions. Over time, aim for a mix – for instance, no more than 20% of your portfolio NOI coming from Tier 1 markets, perhaps 40% from Tier 2, and the rest from Tier 3/4. That way, an insurance catastrophe in one region won’t torpedo your entire business. Geographic diversification isn’t just a buzzword; it’s becoming essential risk management.

&

MAKE IT MODERN

Building Your Climate Risk Data Advantage

Make It Modern: Your Climate Risk Intelligence System

Stop learning about insurance spikes at renewal. Treat this like the data problem it is:

Track Insurance Like You Track Rentals – Simple spreadsheet: property address, annual premium, cost per SF, carrier, deductibles. Do this for your portfolio and gather intel from peers. In two years, you'll know "Tampa storage runs $0.28/sf" while brokers are quoting you $0.15. That's edge.

Better yet: Join operator Facebook groups (Self Storage Operators Network, Facility Nation, etc.). When someone posts about closing on a deal, DM them: "Congrats on the Orlando property - curious what you're seeing on insurance rates there?" Most operators will tell you. Do this 5-10 times and you've got real market data your broker doesn't want you to have. Build the database one conversation at a time.

Use Free Tools Before Every Offer – FEMA flood maps, First Street Foundation's Flood Factor, ClimateCheck.com, Wildfire Risk to Communities. Five minutes of research before you tour a property. If it's in a flood zone or wildfire interface, you know the insurance math before you waste time.

Add climate risk scores to your property pipeline tracker. When you're evaluating three deals side-by-side, seeing "Flood Factor: 9/10" next to the Florida property versus "Flood Factor: 2/10" for the Ohio property makes the real cost differential obvious.

Stress Test Your Model – Add one toggle: "Insurance +100% in Year 3." If your IRR collapses or DSCR breaks loan covenants, kill the deal or reprice it. Don't hope it won't happen. Run every deal through this scenario before you go hard on earnest money.

For bonus points: Model a simultaneous insurance spike + major deductible hit in Year 4 (say, $50K out of pocket from a hail storm). If the deal still works, you've got cushion. If it breaks, you're buying someone else's future problem.

The Real Arbitrage – While everyone chases high-growth Sunbelt cities and gets destroyed by insurance, you're buying Indianapolis, Columbus, Kansas City. Slightly lower cap rates, dramatically lower expense risk. Over 10 years, the "boring" Midwest facility probably outperforms Miami once you factor true costs.

Insurance actuaries aren't panicking - they're following loss data. When carriers flee California or hike Florida rates 40%, they're telling you something. Listen.

&

BEFORE YOU GO

Links I found interesting this week

&

FROM THE STOICS

The whole future lies in uncertainty: live immediately.

— Seneca