Welcome back to Exit & Equity, the email for serious self storage owners.

It's December 12, 2025. You have 19 days until the calendar flips to 2026.

Every day that passes is a day you can't get back for tax strategy, expense timing, or financial positioning. I know what you're thinking: "I'll deal with taxes in April when I file."

That is expensive thinking - Let’s get to it!

&

IN THE KNOW

YOUR DECEMBER ACTION LIST

These aren't in priority order, they're all high-value. Read through the full list, then tackle the ones that apply to your situation. Even implementing 2-3 of these will materially improve your tax position and 2026 operations.

MAX OUT BONUS DEPRECIATION (IT'S BACK TO 100%)

Earlier this year, we were operating under the assumption that bonus depreciation was phasing down to 40%. That is no longer true. The "One Big Beautiful Bill Act" (OBBBA), signed on July 4, 2025, retroactively restored 100% Bonus Depreciation for qualified assets placed in service after January 19, 2025.

What Qualifies:

Equipment: Golf carts, Locks, tools, moving trucks

Security: Cameras, gate motors, keypads, monitors, access control systems

Tech: Computers, servers, kiosks, management software

Vehicles: Trucks and heavy SUVs (with specific rules)

The limit for Section 179 expensing has been raised to $2.5 million for 2025 giving you maximum flexibility.

The Math:

You need a new gate system and security upgrade = $60,000 total investment.

Purchase on Dec 30, 2025: Deduct $60,000 immediately (100% bonus)

Tax savings (assuming 35% effective rate) = $21,000Purchase on Jan 2, 2026: You still spend the $60K, but the deduction happens next year

Cost of Waiting 3 Days: You lose access to $21,000 of cash flow for 12 months

Real Example:

One operator I know needed $85K in security upgrades across three facilities. By accelerating the purchase from Q1 2026 to December 2025, they captured $29,750 in immediate tax savings. That's cash they can reinvest rather than loan to the IRS interest-free.

Review your 2025 profit, are you showing significant taxable income?

Make a list of equipment you planned to buy in Q1 2026

Call suppliers NOW and see if you can take delivery/install by 12/31

Critical: It must be "placed in service" (installed and functional), not just paid for, to qualify for bonus depreciation

Document everything: delivery dates, installation dates, invoices

Warning: This only makes sense if you're profitable in 2025. If you're showing a loss, these deductions may go unused (though they can carry forward).

ORDER A COST SEGREGATION STUDY

If you bought or built a storage facility in 2025, a cost segregation study is non-negotiable. It reclassifies ~20-30% of your building from 39-year depreciation to 5, 7, or 15-year depreciation schedules. Because the OBBBA restored 100% bonus depreciation, all that reclassified value is deductible immediately.

What Gets Reclassified:

5-7 year property: Carpeting, signage, security systems, certain electrical/plumbing

15-year property: Land improvements (parking lots, fencing, landscaping, site lighting)

Personal property: All fixtures, equipment, and non-structural components

Typical $3M facility purchase:

Standard depreciation: ~$77K/year over 39 years

After cost seg study: ~$600K-$800K accelerated into Year 1 via 100% bonus depreciation

Tax savings (35% rate): $210,000-$280,000 in present-value benefit

Study cost: ~$10K-$15K

ROI: 15-25x return on investment

Real-World Timeline:

Week 1: Engage firm, provide closing documents

Week 2-3: Site visit and engineering analysis

Week 4: Draft report delivered

Filing: Your CPA uses the report for your 2025 return

You can still benefit even if the study isn't complete by December 31st—getting the engagement letter signed demonstrates intent, and many firms can rush critical findings.

Action Items:

If you closed on a facility in 2025, call a cost seg firm THIS WEEK

Typical turnaround: 3-4 weeks if you start now

Even if you bought in 2020-2024, you can catch up via Form 3115 (change in accounting method)

Get quotes from 2-3 firms to compare pricing and methodology

Catch-Up Opportunity: If you bought a facility in 2020-2024 and didn't do cost seg, you can still capture those benefits using a "look-back" cost seg study. You won't get 100% bonus on old purchases, but you'll still accelerate significant depreciation.

Warning: Cost seg creates large deductions now, smaller deductions later. Also consider depreciation recapture on sale if you don't hold long-term (10+ years ideal).

PREPAY 2026 EXPENSES

Cash-basis taxpayers (most small operators) can deduct expenses when paid, provided the benefit doesn't extend beyond 12 months. Pay January 2026 expenses in December 2025 = deduction this year.

What You Can Prepay:

Insurance Premiums: Pay the full year of 2026 in December (most carriers allow this)

Property Taxes: Only if your county has assessed the 2026 tax and accepts early payment

Software Subscriptions: Switch from monthly to annual billing (often saves 10-20% on the cost, too)

Maintenance Contracts: Annual pest control, HVAC service agreements, landscape contracts

Professional Services: Prepay 2026 bookkeeping, property management fees if structured as retainers

What You CANNOT Prepay (IRS Rules):

Expenses that benefit you beyond 12 months (multi-year contracts)

Insurance that covers into 2027

Rent on leased equipment (different rules apply)

The Math:

Prepay $15K in expenses (insurance + software + maintenance contracts):

Tax savings (35% rate): $5,250 immediate

Cash cost: $0 (you were paying this in Q1 2026 anyway—just timing difference)

Benefit: Deduction today vs. deduction next year when you might be in a higher bracket

Strategic Timing:

If you expect significantly higher income in 2026 (maybe you're selling a facility or have a big development stabilizing), prepaying 2025 expenses becomes even more valuable—you're taking deductions at a lower marginal rate.

Action Items:

Pull up your 2026 Q1 expense forecast

Call your insurance agent—can you pay the 2026 premium now?

Review all your subscriptions—any monthly ones you can switch to annual?

Check property tax payment schedule with your county assessor

Contact vendors for maintenance contracts—can you prepay 12 months?

What Happens When $4.7T in Real Estate Debt Comes Due?

A wave of properties hit the market for up to 40% less than recent values. AARE is buying these income-producing buildings at a discount for its new REIT, which plans to pay at least 90% of its income to investors. And you can be one of them.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

MAKE STRATEGIC REPAIRS VS. IMPROVEMENTS

Repairs are immediately deductible. Improvements must be capitalized and depreciated (though 100% bonus depreciation helps). The distinction matters for audit defense and future depreciation recapture when you sell.

IRS Definitions:

Repairs: Maintain property in ordinary operating condition (fix what's broken, restore to previous state)

Improvements: Better the property, restore after deterioration, adapt to new use

Repairs (Immediate Expense):

Fixing a broken gate motor (replacing same type/capacity)

Patching asphalt (not full repave)

Repainting existing surfaces (same color, no expansion)

Replacing broken HVAC unit with equivalent model

Fixing roof leaks (patching, not full replacement)

Repairing damaged doors, locks, lights

Improvements (Must Capitalize):

Adding new units or square footage

Complete roof replacement (extends life beyond original)

Full parking lot repave/expansion

Upgrading to commercial-grade HVAC (betterment)

Major renovations that change use or significantly improve property

The Gray Area:

Some expenses can be argued either way. Work with your CPA to document WHY something is a repair (restore to previous condition) vs. improvement (made it better than before).

The Strategy:

If you're highly profitable in 2025, accelerate repairs into December for immediate deduction. If you expect higher income in 2026, you could defer discretionary repairs to January (though this is harder to control).

The Math:

$30K in needed repairs tackled in December vs. January:

December 2025: $30K deduction in 2025 = $10,500 tax savings now (35% rate)

January 2026: $30K deduction in 2026 = savings next year

If your 2025 income is higher than expected 2026, capturing the deduction now is worth it

Action Items:

Walk your facilities this week—what's broken or needs maintenance?

Prioritize true "repairs" that are immediately deductible

Get quotes from contractors before year-end

Schedule work for completion by December 31st

Make sure work is DONE and INVOICED by 12/31 (not just estimated)

Document with photos: before (broken), after (repaired to original condition)

Documentation Is Key:

Take photos showing you're restoring to previous condition, not improving beyond original state. This defends your expense classification if audited.

AUDIT YOUR SOFTWARE COSTS (AND USE WHAT YOU'RE PAYING FOR)

2025 saw aggressive price hikes in business software. QuickBooks Online Advanced now lists around $275/month, and subscription creep is real. December is the time to audit whether you're using what you're paying for and potentially prepay 2026 at a discount.

Common Software Cost Creep:

Accounting: Are you using QBO Advanced features ($275/mo) or could you downgrade to Plus ($100/mo)?

Property Management: Paying for 3 facilities but only operating 2?

Receipt Capture: Subscribed to Dext but still using shoeboxes?

Mileage Tracking: Paying $10/month for MileIQ but not swiping trips?

The Audit:

Pull your December credit card statement

List every software subscription

For each one ask: "Am I using this weekly? Does it save me time or money?"

Cancel anything you haven't logged into in 60+ days

Downgrade anything where you're paying for unused features

If you find software you ARE using, prepay 2026 now to:

Capture 2025 tax deduction (see Move #3)

Often get 10-20% annual payment discount

Lock in 2025 pricing before 2026 increases

Action Items:

Review all software subscriptions on credit card/bank statements

Cancel unused subscriptions immediately (stop the bleed)

Downgrade overpriced tiers you're not fully utilizing

For keepers: Contact vendors and prepay 2026 for discount + tax deduction

Set a 2026 reminder to review again next November

The "Use It or Lose It" Mentality:

If you're paying for receipt capture software (Dext, Hubdoc), make 2026 the year you actually use it. Set up auto-forwarding from your email receipts, snap photos of paper receipts weekly. The software only has ROI if you use it.

While there are smart year-end strategies, there are also traps. Here's what NOT to do:

Don't: Chase Solar Tax Credits (They're Mostly Gone)

Under the OBBBA, most commercial solar tax credits have been eliminated or severely restricted as of 2025. Don't sign a solar contract in December expecting the old 30% ITC credits—they likely don't exist for your deal anymore. If your solar sales rep says otherwise, verify independently with your CPA.

Don't: Rush a Bad Equipment Purchase

Buying something you don't need just to "save on taxes" is losing money. Spending $50K to save $17.5K in taxes means you're still out $32.5K. Only accelerate purchases you were already planning to make in Q1 2026. The tax tail shouldn't wag the business dog.

Don't: Panic-Buy Heavy Vehicles Without Research

While the Section 179 limit for heavy SUVs (>6,000 lbs) is $31,300 plus 100% bonus depreciation on the balance, you must have a legitimate business need and >50% business use. Buying a "company G-Wagon" that sits in your home driveway is a red flag for audits. The IRS knows this game.

Don't: Manufacture Fake Expenses

Accelerating legitimate expenses = smart. Creating bogus expenses or inflating invoices = fraud. The IRS has seen every trick. Don't risk an audit nightmare to save a few thousand in taxes.

Don't: Make Major Entity Changes Without Professional Help

Switching from LLC to S-corp, adding partners, restructuring ownership—these have complex tax implications. December 31st is not the time to DIY major entity changes. Discuss with your CPA in Q1 2026 for implementation later in the year with proper planning.

Don't: Ignore Your CPA Until December 28th

If you want to implement any of these strategies, call your CPA NOW. They're slammed in December and January with year-end planning and tax season prep. You need their input on what makes sense for YOUR specific situation. Don't be the client who calls on December 30th expecting miracles.

The Bottom Line:

Good tax strategy is intentional, not desperate. If a move doesn't pass the "would I do this even without the tax benefit?" test, skip it.

&

MAKE IT MODERN

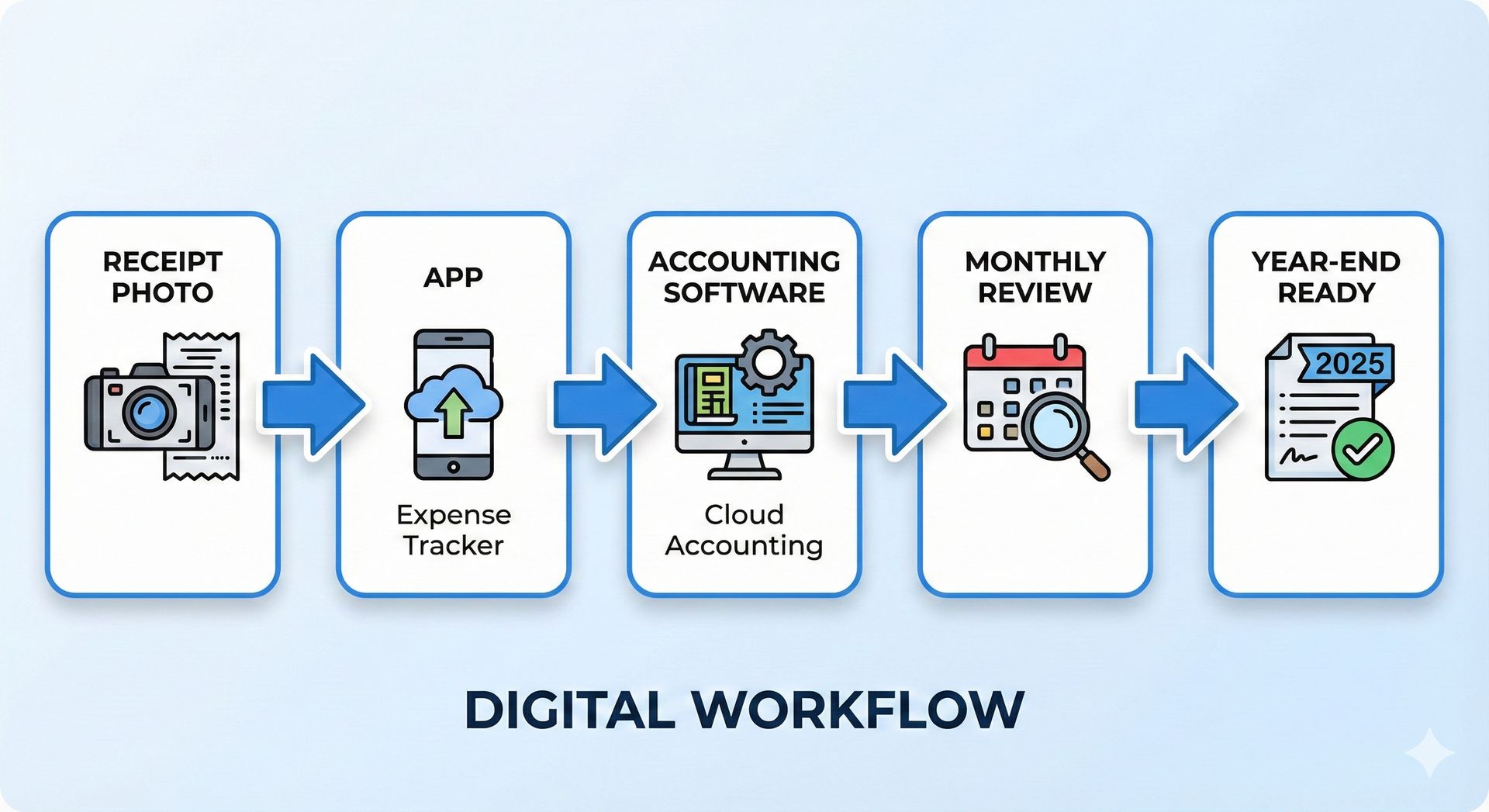

MAKE IT MODERN: AUTOMATE YOUR 2026 TAX TRACKING

The reason December feels like a scramble is because you didn't track things systematically throughout 2025. Here's how to fix that for 2026 so next December is smooth instead of stressful.

THE AUTOMATION STACK (Total Cost: <$200/month, Value: Priceless)

Most operators lose $5K-$10K in deductions annually because they don't have systems to capture expenses in real-time. The solution isn't more discipline, it's better automation. Here's how to fix that:

1. Digitize Receipt Capture

Stop stuffing receipts in shoeboxes. Use Dext ($20-50/mo) or Xero mobile app. Snap photo → auto-extract data → sync to books. Takes 5 seconds per receipt vs 2 hours in December reconstructing.

2. Automate Mileage

Install MileIQ ($100/year) or Everlance ($60/year). Auto-tracks every drive. Swipe right (business) or left (personal) at trip end. Protects $5K+ annual deduction with zero effort.

3. Monthly Review Ritual (This is first on my list to implement in 2026)

Calendar: 5th of every month, 20-minute review.

Reconcile bank/credit card statements

Categorize "uncategorized" transactions

Scan P&L for anomalies

20 minutes/month saves 20 hours in December

4. Quarterly CPA Check-Ins

Don't wait until April. Schedule 15-minute calls in March, June, September, December to discuss estimated payments, big purchases, income projections.

The Tech Stack: <$200/month total

Xero Online: $30-100/mo

Dext or Hubdoc: $20-50/mo

MileIQ: $8/mo

Annual deductions captured that you'd otherwise miss: $5K-$10K

Disclaimer: This article is for educational purposes only and does not constitute tax, legal, or financial advice. Consult with a qualified CPA or tax advisor before implementing any strategies.

&

BEFORE YOU GO

Links I found interesting this week

&

FROM THE STOICS

You could leave life right now. Let that determine what you do and say and think.

— Marcus Aurelius